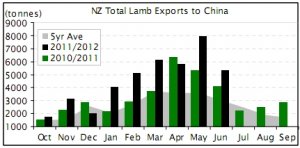

NZ lamb supply is seasonally falling and this has flowed onto June's exports stats. But when compared to the same time last year, the country that sticks out like a sore thumb is China. NZ lamb exports to China in June were up nearly a third on last year to 5,351t. Season to date exports to China are now up 32% or an additional 10,000t. China predominantly imports lower valued frozen cuts from NZ, but the variety of cuts it's willing to take on is expanding. NZ exporters have been able to offload surplus frozen legs and shoulders which would have traditionally headed to the EU. Other regions that have experienced lamb export growth this season are the Middle East and Africa, up 25% and 27% respectively.

Limited trades in the US market

Cost aside, the US prefers NZ French Racks over the likes of Australia as we can produce lighter cuts. This is because Australia mainly farms merino's which typically have a higher carcass weight than other meat breeds. However, NZ is struggling to get rid of an abundance of heavy cuts this season. This has slowed trading with the US because we are competing directly with Australia and the US simply cant get what they want. French rack prices have remained fairly stable on limited trades at around US$12/lb for under 16 ounces. Anything over 16 ounces gets discounted and can be US$11/lb and less.

In the last four months, NZ lamb exports to the US have remained below last years levels with 2,460 fewer tonnes shipped. June exports were just 1,133t, down 32% on 2011.

More lamb bought in UK supermarkets

Lamb consumption in the UK deteriorated as lamb became too dear. Lamb was virtually being priced out of the market as consumers switched to cheaper protein alternatives such as chicken. However, supermarkets in the UK and NZ continue to discount lamb, in particular lamb legs, which is stimulating lamb purchases. According to the latest Kantar Worldpanel data, total UK household expenditure on lamb for the 4 weeks ended 10 June 2012 was up 4% on the same period last year. Lamb prices were back 6.2% which would have driven the 10.8% increase in purchase volumes.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |